Employee benefits are increasingly seen as a critical component of an organisation’s total rewards provision. Well-designed strategies support talent attraction and retention, as well as providing an opportunity to reflect on your organisation’s talent strategy in a personal and tangible benefits experience.

Through a combination of benefits broking, consultancy services and clinical expertise, you can:

- Review and enhance your benefit plan design

- Optimise benefit financing

- Manage and reduce absence

- Manage and control costs associated with medical inflation and rising premium costs

- Implement effective benefits governance

- Meet duty of care and legislative obligations

Our approach to employee benefits

Getting to the heart of your employee benefit strategy is complex. It requires balancing many factors such as

- Design competitiveness

- Employee experience

- Cost optimisation

Furthermore, you need to find the right data for analytics to refine your employee benefits strategy. And to implement it effectively, you need the right balance of technology for benefits administration.

Our employee benefits framework

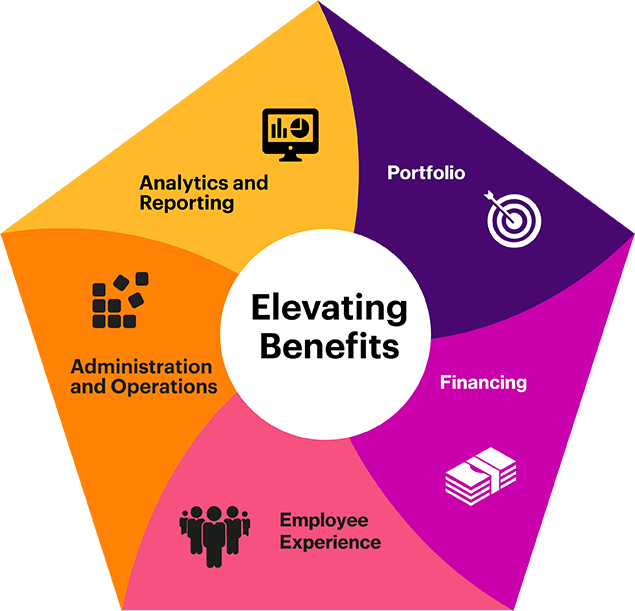

It’s helpful to have a framework to help design and maintain an effective employee benefits program. Our Strategy Navigator outlines the five critical components of an exceptional employee benefits package.

Elevating benefits

Benefits portfolio

Benefits financing

Employee experience

Benefits administration and operations

- Benefits portfolio: Align benefits portfolio with business and talent goals, company culture and purpose, employee needs and industry and market norms

- Benefits financing: Manage company cost (spend money where it has the highest impact and risk)

- Employee experience: Maximize employee value and appreciation through awareness, decision-support and engagement

- Benefits administration and operations: Optimize internal and external resources and technology solutions to deliver operating efficiency

- Benefits analytics, insights and reporting: Apply data-driven insights to inform decision-making and measure outcomes

Many organisations or their leadership make bold statements with respect to “caring for our employees” or making a “commitment to support mental health.” Designing a thoughtful employee benefits portfolio is a clear way to show alignment between an organisation’s strategy and employee experience.

Do the benefits you offer truly matter?

Employee benefits can help you achieve your organisation’s talent goals and ultimately drive business results. We ask:

- Do the benefits you offer truly matter to your employees?

- What are the core employee benefits that are needed to compete within a market or industry?

What are the additional benefits that you can provide on a voluntary or optional basis?

The perennial question asked of benefits leaders is, “What’s the return on investment?” Organisations tend to turn a critical eye to the enormous investment made in employee benefits, especially when the financial environment is more challenging. Your responsibility as a benefits leader is to ensure that benefits spending is optimal.

It’s important to look at different avenues of financing employee benefits, for example cost-sharing. Risk management is also a critical element of financing. Consider:

- What’s the appropriate division of cost between employer and employee?

- What are opportunities to protect the company from excess or unexpected cost by leveraging partners or mechanisms to mitigate financial risk?

The most robust employee benefits program has no impact if employees are not aware that the benefits exist. Unfortunately, this is one of the most common complaints of benefits leaders — that employees don’t know what they have. Establishing and maintaining a dialogue with employees (and covered dependents) is important to increase awareness.

Clear, accessible communication is a key element of a benefits program.

Sometimes employees are saturated with information and sometimes, particularly in the “moments that matter” (e.g., a health crisis), the benefits program information is inaccessible or difficult to understand.

Clear, accessible communication is a key element of a benefits program. When you communicate your benefits program clearly, you elevate the employee experience.

The success of an employee benefits program often requires a tightly run benefits administration plan. Employee benefits programs meet or exceed financial and talent goals by leveraging constantly evolving technology and include a tight benefits administration process to drive efficiency.

We can enable you to ensure that your employee benefits program effectively leverages external capabilities and focuses internal resources on the critical elements of the benefits program. We also can help you improve productivity through effective partnerships that outsource the critical elements of the benefits experience to organisations specializing in employee benefits.

In the modern work environment, data sits at the core of all decision making. The challenge (and therefore, the opportunity) is to identify the critical benefits data needed to inform employee benefits design and administration.

Data comes in two forms:

- Internal, e.g., program utilisation — are employees engaging and using benefits at the level that we are expecting?

- External, e.g., benchmarks — what’s the competitive practice and what do employees expect when evaluating a benefits package?

“Set it and forget it” is a strategy of the past. Measuring the impact of a program change, soliciting feedback, and continuously refining and improving the employee benefits program is critical to ensure that your employee benefits meet the needs of a changing workforce.